In our increasingly connected global economy, where financial operations have been shifting rapidly to digital platforms, the security of transactions is becoming ever more urgent. Whether it’s a payment to a supplier or vendor, a receipt from a client or customer, or even an employee benefits reimbursement, every financial exchange presents opportunities for cyber criminals to exploit vulnerabilities for financial gain. And with projections that in the next decade digital technology will drive 70% of new value created in the global economy will be driven by digital technology, protecting against transactional cyber fraud will remain a critical business objective.1

Many factors have affected the transactional fraud landscape, including more complex supply chains, the rise of cryptocurrency, the proliferation of digital platforms that enable transactions across the globe and the growing popularity of real-time payment systems that promise frictionless transactions.

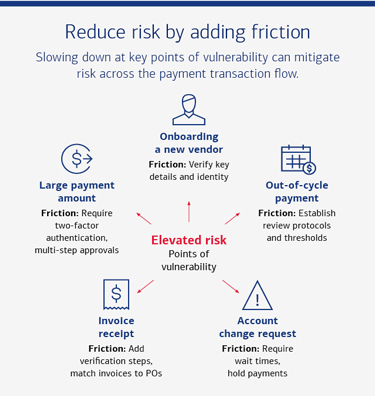

What unifies these developments is the absence of a human at many points along a transaction pathway. While automation and digital connectivity have successfully accelerated payment systems, they have also reduced human oversight and opened the door for potential cyber malfeasance. Removing friction facilitates not only legitimate business operations, but also new types of fraud.

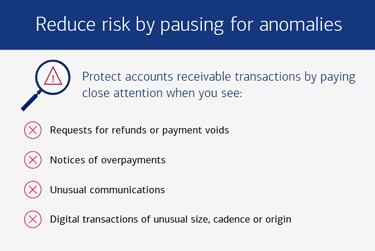

Fraudsters can also exploit trust, not just in the legitimacy of the entities sending and receiving payments, but also in the secure nature of the technology. The benefits of real-time payments are obvious, but can businesses reduce the concurrent risks?