On this page

Economic and market brief

Monthly economic and market insights for business leaders

January 15, 2026

Why businesses are doubling down on artificial intelligence

In 2026, the outlook for consumer spending is steadier and more complex than many expected. While economic uncertainty continues to dominate headlines, recent data suggests consumers and business owners are adapting rather than retreating.

Artificial intelligence sits at the center of that shift. According to the 2025 Business Owner Report, 77% of businesses have now integrated AI into their operations. What was once experimental has become operational. The focus has shifted from curiosity to impact, especially in productivity, efficiency, and long-term competitiveness.

At the same time, small business owners are exercising more discipline. “There was almost a 10% growth in the amount of money that small businesses are spending and investing in AI. And that's even as they're pulling back in some other discretionary areas like travel, like advertising,” says Liz Everett Krisberg, head of the Bank of America Institute, to Chris Hyzy, Chief Investment Officer for Merrill and Bank of America Private Bank.

Rather than reacting to uncertainty, business owners are reallocating capital toward tools they believe will pay off. They are cutting costs that feel optional and protecting investments that support resilience and scale.

The takeaway heading into 2026 is straightforward. Consumer and business-owner spending is becoming more intentional, data-driven, and aligned with long-term value creation.

December 7, 2025

Powering up: What could drive the next era of growth?

A massive economic shift is underway, and it is bigger than any single sector or policy debate. Across energy, infrastructure, technology and finance, the world is transitioning into a new system shaped by climate pressures, geopolitical risk, rapid innovation and changing human needs. Instead of focusing only on carbon reduction, this transition is about rebuilding and future-proofing the fundamental systems that keep modern life running.

Chris Hyzy, Chief Investment Officer for Merrill and Bank of America Private Bank, and Haim Israel, Head of Global Thematic Investing for BofA Global Research, discussed a new five-pillar “ABCDE” framework breaks down what that global transformation looks like in practice.

“We’re in the middle of a tech revolution, something that we’re never, ever seen in the past. We need more resources, geopolitical implications left and right. Things are accelerating very fast," Israel said. “As a result, we think we need to start talking about transition and solution. We need to start adapting into the new world because the new world is changing so fast. Most important, when we add up all of our different needs, our risks, everything that we need to confront in the next couple of years, we’re getting to trillions of trillions of dollars of investments.”

Israel outlines his ABCDE framework for transition investing:

- Adaptation and resilience come first because the shocks are already here. Climate events, supply chain disruptions and geopolitical tensions led to $80 billion in insured losses in the first half of the year. That number is a wakeup call. Nations and companies are now investing heavily in security, defense and infrastructure that can absorb future disruption. Adaptation is no longer optional. It is becoming a trillion-dollar priority.

- Built infrastructure and resources are the next bottleneck. The global economy is only 7% circular and material use has tripled in 50 years. With energy demand expected to double by 2030, everything from power grids to water systems needs upgrading. That requires long term investment and global coordination.

- Clean energy is no longer just about transition. It is about addition. Solar and storage dominate new capacity. Nuclear and small modular reactors are returning to the conversation as strategic assets. Clean tech investment is projected at $2.2 trillion this year and that momentum continues to build.

- Digital and human capital sit at the center of the transformation. AI could save $150 billion a year in US healthcare, but it will also reshape jobs, training and workforce needs. The future economy depends as much on skilled people as it does on advanced machines.

- Enabling finance, finally, is accelerating all this activity. Capital is already flowing into transition themes at scale, from infrastructure to defense to renewable power. The real story is not just money. It is momentum.

The transition is already happening. The only question now is whether business owners will adapt fast enough to profit from it.

November 20, 2025

Insights from the 2025 Business Owner Report: AI adoption, expansion plans and economic concerns

Bank of America’s 2025 Business Owner Report offers a clear look at how small and mid-sized business owners view the year ahead. The primary takeaway is this. Growth is still the focus even as inflation, supply chain pressures and labor shortages create challenges.

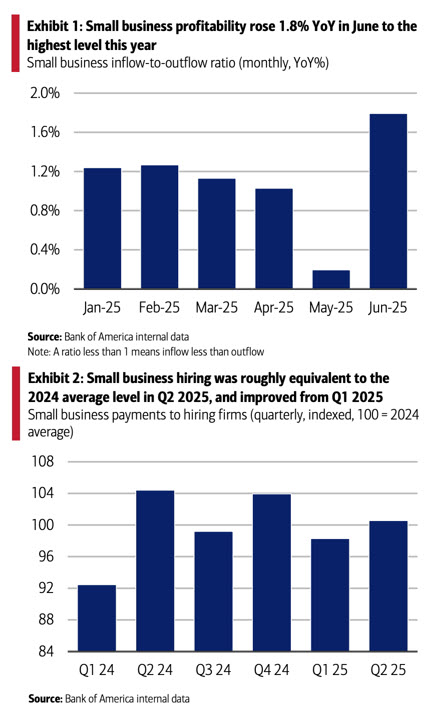

According to the report, 74% of business owners expect revenue to increase in the next year and nearly 60% plan to expand their businesses. This is consistent with Bank of America Institute data showing that small business profitability has still been resilient throughout 2025. About half of business owners are hopeful that the local, national and global economies will improve. Their confidence is closely tied to key factors like stabilizing tariff policy, cooling inflation, lower interest rates and stronger supply chains.

Sharon Miller, President and Co-Head of Business Banking at Bank of America, says this sense of cautious optimism is well earned. “Business owners are approaching the coming year with confidence and a clear focus on growth. Many plan to retain their current staff and hire more and anticipate that local, national and global economies will improve.”

The report also sheds light on pressures from a tight labor market. 61% of business owners say they are affected by labor shortages. Many are responding by personally working more hours and raising wages to attract competitive talent. Only 1% are planning layoffs in the next year while 43% expect to hire.

Inflation continues to affect 88% of business owners. As a response, 64% are raising prices and 39% are reevaluating cash flow and spending strategies.

Digital transformation is clearly accelerating. 77% of business owners have already integrated AI into operations including marketing, content creation and customer service. And 91% plan to adopt more digital tools in the next five years. These investments include accepting more digital payments, streamlining workflows and improving cybersecurity.

Read the full report and use real insights from business owners to drive smarter decisions in 2025.

October 27, 2025

Resilient U.S. growth powered by strong wages and AI investment

Business owners must be nimble when there’s a lack of official data, such as during a government shutdown. Bank of America internal data signals that U.S. job growth likely continued to decline. However, wage growth is picking up across income levels, even if high earners are faring better than lower-income households. This combination of higher wages and strong spending is supportive of resilient U.S. growth.

Bank of America data shows that small business profitability, measured by the inflow-to-outflow ratio, has held steady, though slower deposit growth suggests moderating revenues. Alternative hiring indicators fell 7% in September from the 2024 average, with business applications signaling softer job creation. Meanwhile, credit card balances rose 3% as firms carried more debt, but easing lending standards indicate credit access remains resilient.

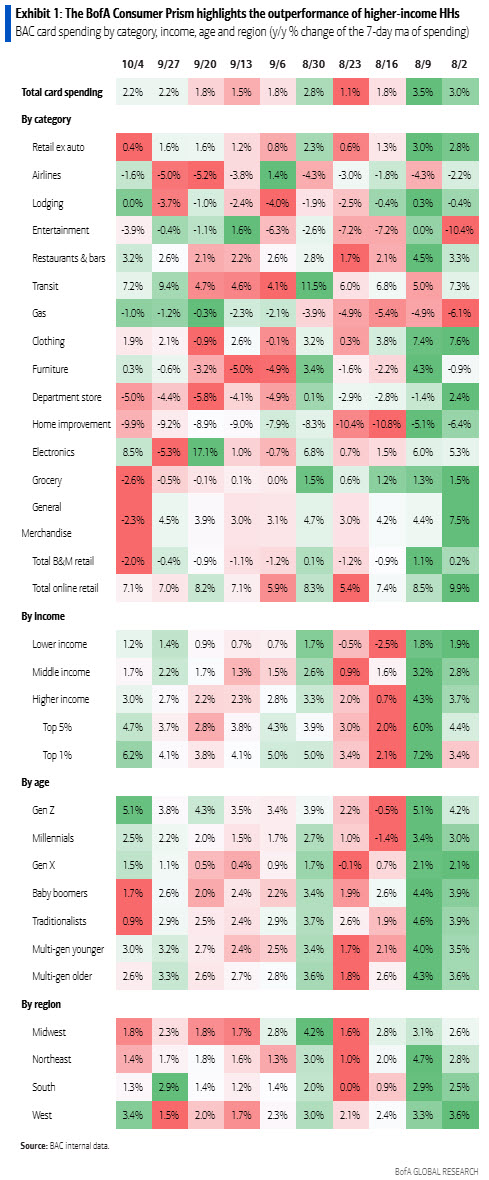

As more people look to alternative data to fill in the gaps, Bank of America created a heatmap, called the Bank of America’s Consumer Prism, using the bank’s total aggregated credit and debit card spending data by category, income, age and region. See Exhibit 1.

Two trends stand out in the BofA Consumer Prism for business owners. First, growth in higher-income spending continues to outpace lower-income spending. The top 5% and top 1% are seeing particularly robust year-over-year spending growth rates. Second, Gen X households have had the weakest spending growth for most of the last quarter. Unlike younger generations, earnings might have peaked for many Gen X-ers, but they potentially haven't accumulated as much equity and real estate wealth as older generations. These insights can help business owners adjust what consumers they target and look for unmet needs in the market.

Where the AI boom fits into the economic data

In Bank of America client talks, one of the most frequently discussed topics is AI and what it means for growth, productivity, and the labor market. The most immediate effect from AI on the economy is the investment, bank analysts say. This should continue to be a boon for growth, though tariff frontloading blurs the picture. Bank analysts do not find evidence of AI usage leading to job losses, especially across white collar occupations. The productivity story seems to be winning, at least so far.

September 29, 2025

From bricks to bytes: Artificial intelligence for business owners

It’s been nearly three years since artificial intelligence (AI) went public. In that time, its promise has grown every quarter across seemingly every sector of the economy. Amid stunning headlines touting Big Tech’s capital mobilization, over $300 billion1 in planned spending in 2025 alone, investors are keen to understand how they could potentially benefit from this revolutionary technology. “We haven’t even scratched the surface about how much money is needed,” says Haim Israel, Head of Global Thematic Research for BofA Global Research.

In the video above, Israel talks to Chris Hyzy, Chief Investment Officer, Merrill and Bank of America Private Bank, about the trajectory of the AI buildout, the race between U.S. and China for dominance, and potential beneficiaries — from commodities, such as copper, nickel and silicon, to sectors including energy and transportation — that may feel an AI boost. Additionally, they discuss the risks associated with AI and what you should keep an eye on as this technology revolution accelerates.

1 Tech megacaps plan to spend more than $300 billion in 2025, Samantha Subin. CNBC, Feb. 8, 2025.

September 8, 2025

Top lessons from the 2025 Workplace Benefits Report

Running a business today means balancing growth with the reality of employee needs. The 2025 Workplace Benefits Report highlights where employees are struggling and what business owners should prioritize in 2025.

What employees want

Employees are under pressure. Eighty-five percent carry personal debt, and more than half have credit card balances. Retirement and emergency savings are still top priorities, yet half haven’t reached their emergency savings goal, often because debt repayment takes precedence. This stress pushes workers to look beyond traditional health insurance and 401(k)s. They want help managing debt, planning retirement income, and building financial skills.

One of the clearest signals in the report is the power of equity. Seventy-one percent of employees say stock awards influenced their decision to accept or stay in a job. Career optimism is also higher for those who receive equity (70% versus 64% without). Yet few small businesses extend equity broadly, leaving a strong retention lever untapped.

Communication is another weak spot. Even when benefits exist, employees often don’t know about them. Only 39% of workers are aware of investment services at work, compared with 52% of employers who say they provide them. Similar gaps appear in mentoring, wellness reimbursements, and emergency loans.

Where small businesses lag

The divide between large and small firms is sharp. Employees at large companies report greater financial well-being (57%) than those at small businesses (41%). Larger employers are more likely to offer financial wellness programs, while 51% of small businesses focus mainly on competitive fees.

Technology is widening the gap. Eight in 10 employers use AI for efficiency and talent management, but nearly a third of small businesses don’t use it at all. Only 21% of small firms say AI improves hiring, compared with 46% of large employers.

The takeaway is simple: benefits strategy is business strategy. In 2025, employees expect equity, savings support, debt solutions, smart use of AI, and clear communication. To explore tailored solutions for your business, consider speaking with a Bank of America relationship manager.

July 17, 2025

Small business profitability is up, but hiring has moderated from last year

Small business payments to hiring firms were down 3.4% YoY in June on a three-month moving average, though remain relatively equal to the 2024 average level (Exhibit 2). However, on a month-over-month (MoM) basis, in June, such payments rose 2.2% from May on a three-month moving average.

July 9, 2025

Will the U.S. economy enter the “R” zone this year?

After weeks of tariff-related business disruptions, economic uncertainties and market volatility, ongoing trade talks have eased widespread fears of a 2025 recession. “Beyond those encouraging signs, there are other reasons to believe we’ll avoid a recession,” says Marci McGregor, head of Portfolio Strategy for the Chief Investment Office (CIO), Merrill and Bank of America Private Bank. “At a difficult moment, the U.S. economy has shown remarkable resilience.”

In the video above, McGregor explains why and how consumer spending and the labor market have outperformed expectations despite widespread fears that both might wither in the wake of trade disputes. While a recession could still happen, the power of the U.S. economy and higher individual wealth relative to liabilities have buffered the economy, McGregor says.

Important disclosures:

The opinions expressed are as of 5/28/2025 and are subject to change.

Investing involves risk, including the possible loss of principal.

Past performance is no guarantee of future results.

The Chief Investment Office (CIO) provides thought leadership on wealth management, investment strategy and global markets; portfolio management solutions; due diligence; and solutions oversight and data analytics. CIO viewpoints are developed for Bank of America Private Bank, a division of Bank of America, N.A., (“Bank of America”) and Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S” or “Merrill”), a registered broker-dealer, registered investment adviser and a wholly owned subsidiary of Bank of America Corporation (“BofA Corp.”).

Ready to meet with a specialist?

Our specialists are ready with advice and guidance to help move your business forward.

Ready to meet with a specialist?

Our specialists are ready with advice and guidance to help move your business forward.

Important Disclosures and Information

"Bank of America" and "BofA Securities" are the marketing names used by the Global Banking and Global Markets divisions of Bank of America Corporation. Lending, derivatives, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Trading in securities and financial instruments, and strategic advisory, and other investment banking activities, are performed globally by investment banking affiliates of Bank of America Corporation ("Investment Banking Affiliates"), including, in the United States, BofA Securities, Inc., which is a registered broker-dealer and Member of SIPC, and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. is a registered futures commission merchant with the CFTC and a member of the NFA.

“Retirement and Personal Wealth Solutions” is the institutional retirement business of Bank of America Corporation (“BofA Corp.”) operating under the name “Bank of America.” Investment advisory and brokerage services are provided by wholly owned non-bank affiliates of BofA Corp., including Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as "MLPF&S" or "Merrill"), a dually registered broker-dealer and investment adviser and Member SIPC. Banking activities may be performed by wholly owned banking affiliates of BofA Corp., including Bank of America, N.A., Member FDIC.

Investing involves risk, including the possible loss of principal. Past performance is no guarantee of future results.

Investments have varying degrees of risk. Some of the risks involved with equity securities include the possibility that the value of the stocks may fluctuate in response to events specific to the companies or markets, as well as economic, political or social events in the U.S. or abroad. Bonds are subject to interest rate, inflation and credit risks. Treasury bills are less volatile than longer-term fixed income securities and are guaranteed as to timely payment of principal and interest by the U.S. government. Investments in a certain industry or sector may pose additional risk due to lack of diversification and sector concentration. There are special risks associated with an investment in commodities, including market price fluctuations, regulatory changes, interest rate changes, credit risk, economic changes and the impact of adverse political or financial factors.

Diversification does not ensure a profit or protect against loss in declining markets.

Opinions are as of the date of these articles and are subject to change.

This information should not be construed as investment advice and is subject to change. It is provided for informational purposes only and is not intended to be either a specific offer by Bank of America, Merrill or any affiliate to sell or provide, or a specific invitation for a consumer to apply for, any particular retail financial product or service that may be available.

These materials have been prepared by Bank of America Institute and are provided to you for general information purposes only. To the extent these materials reference Bank of America data, such materials are not intended to be reflective or indicative of, and should not be relied upon as, the results of operations, financial conditions or performance of Bank of America. Bank of America Institute is a think tank dedicated to uncovering powerful insights that move business and society forward. Drawing on data and resources from across the bank and the world, the Institute delivers important, original perspectives on the economy, sustainability and global transformation. Unless otherwise specifically stated, any views or opinions expressed herein are solely those of Bank of America Institute and any individual authors listed, and are not the product of the BofA Global Research department or any other department of Bank of America Corporation or its affiliates and/or subsidiaries (collectively Bank of America). The views in these materials may differ from the views and opinions expressed by the BofA Global Research department or other departments or divisions of Bank of America. Information has been obtained from sources believed to be reliable, but Bank of America does not warrant its completeness or accuracy. Views and estimates constitute our judgment as of the date of these materials and are subject to change without notice. The views expressed herein should not be construed as individual investment advice for any particular person and are not intended as recommendations of particular securities, financial instruments, strategies or banking services for a particular person. This material does not constitute an offer or an invitation by or on behalf of Bank of America to any person to buy or sell any security or financial instrument or engage in any banking service. Nothing in these materials constitutes investment, legal, accounting or tax advice.

Bank of America, Merrill, their affiliates and advisors do not provide legal, tax or accounting advice. Consult your own legal and/or tax advisors before making any financial decisions. Any informational materials provided are for your discussion or review purposes only. The content on the Center for Business Empowerment (including, without limitations, third party and any Bank of America content) is provided “as is” and carries no express or implied warranties, or promise or guaranty of success. Bank of America does not warrant or guarantee the accuracy, reliability, completeness, usefulness, non-infringement of intellectual property rights, or quality of any content, regardless of who originates that content, and disclaims the same to the extent allowable by law. All third party trademarks, service marks, trade names and logos referenced in this material are the property of their respective owners. Bank of America does not deliver and is not responsible for the products, services or performance of any third party.

Not all materials on the Center for Business Empowerment will be available in Spanish.

Certain links may direct you away from Bank of America to unaffiliated sites. Bank of America has not been involved in the preparation of the content supplied at unaffiliated sites and does not guarantee or assume any responsibility for their content. When you visit these sites, you are agreeing to all of their terms of use, including their privacy and security policies.

Credit cards, credit lines and loans are subject to credit approval and creditworthiness. Some restrictions may apply.

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S" or “Merrill") makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (“BofA Corp."). MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC, and a wholly owned subsidiary of BofA Corp.

Banking products are provided by Bank of America, N.A., and affiliated banks, Members FDIC, and wholly owned subsidiaries of BofA Corp.

“Bank of America” and “BofA Securities” are the marketing names used by the Global Banking and Global Markets division of Bank of America Corporation. Lending, derivatives, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Trading in securities and financial instruments, and strategic advisory, and other investment banking activities, are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, BofA Securities, Inc., which is a registered broker-dealer and Member of SIPC, and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. is a registered futures commission merchant with the CFTC and a member of the NFA.

Investment products: