Retirement planning tips for business owners

June 9, 2025 | 4 minute read

“Retirement.” Just the sound of the word is enough to send chills up many entrepreneurs’ spines. The idea of giving up control of a business you’ve nurtured and grown might seem inconceivable. But health, family obligations and changing priorities can raise questions about what you want your retirement to look like. Do you want to stay involved in the company? Pass the baton to the next generation or someone you’ve groomed to take over? Or would you prefer to sell or close the business?

This is a very personal decision, and there’s no wrong answer. “No one can tell you what’s best for you,” says Judith Anderson, Senior Vice President and Senior Workplace Benefits Product Manager at Bank of America.

Option 1: Staying connected

Remaining involved in your business in a more limited capacity will allow you to continue harvesting income from it and stay connected with colleagues — minus the pressure of running the show. Many entrepreneurs find it rewarding to shift away from day-to-day responsibilities, instead providing higher-level oversight, coming in as an occasional troubleshooter or consultant for the business. “Just eight to 10 hours a week might be enough to keep you engaged,” Anderson says.

There’s a drawback to this arrangement, however — you’re no longer the boss, and you may not have the final say in decisions. Additionally, the financial rewards of selling the business will be postponed. And your ongoing commitments may limit your freedom to travel or enjoy other activities whenever and for as long as you want.

Option 2: Passing the baton

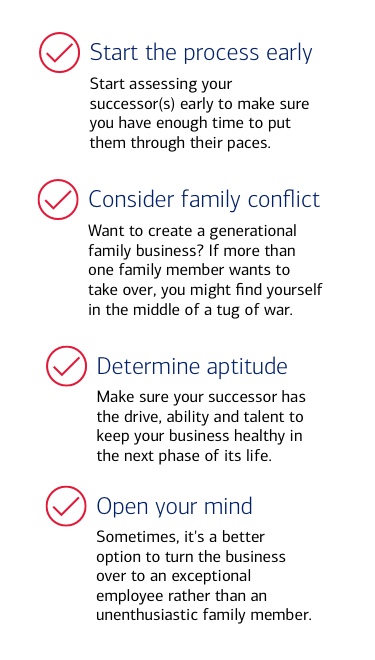

Many entrepreneurs hope to transfer their business to a family member when they retire as a means of creating a legacy for future generations. If this is your goal, it’s essential to discuss it with potential successors early on to ensure they are fully on board with your vision—and the demands keeping it alive will require.

Transferring ownership of a business to a family member as a giſt is also an option. However, this could have several financial consequences: You may no longer receive income from the business; you won’t reap the financial rewards of selling it; and you may have to pay a giſt tax, depending on the value of the business. Additionally, there could be tax repercussions for your successor. Consult with financial and tax advisors for guidance, and with an attorney to ensure your wishes are reflected in your will.

Option 3: Selling the business

If you opt to sell your business, start planning well in advance. You'll need to get your financials in order and should take important steps beforehand, such as asking key employees to sign agreements and to stay on aſter the sale. Such actions may give potential buyers some confidence that the business will continue to perform successfully without you.

Keep in mind that not all businesses are salable. And economic factors that are out of your control, such as a recession or significant market shiſts, may affect the valuation of your business. In addition, even if you prefer to receive the proceeds in one lump sum, you might find that your buyer will need to make payments over time, which could have implications for your plans in retirement.

Considerations when stepping away

Your finances today

Review your assets with your financial advisor to help determine if it’s the right time to retire. Be sure to include any real or anticipated proceeds from selling your business, as well as retirement savings, investments and income from Social Security payments. In some cases, building up your savings and delaying Social Security payments for a few more years can help strengthen your financial foundation in retirement.

Your ongoing financial obligations

Review your budget to make sure you can cover your monthly expenses with some combination of savings, Social Security, retirement and investment accounts. If necessary, downsizing to less expensive housing and reducing other costs may also make it possible to retire when and how you wish.

Knowing how you want to spend your time

Not all considerations are financial. Knowing what you want to do in the next phase of your life—whether that’s traveling, volunteering, visiting grandchildren or enjoying hobbies—will help you determine whether staying on or letting go is the best option for you.

There’s no definitive “right way” to transition out of full-time entrepreneurship. But with careful financial planning and a thoughtful eye to the future, you can help ensure you enter your next chapter on your own terms.

Bank of America Workplace Benefits™ for small business owners and entrepreneurs

Find out how our experienced team can help you build a benefits plan that truly fits your business's needs.

Employee benefits guide for small business owners

Questions about what benefits to offer your employees? You'll find answers here.

Bank of America Workplace Benefits™ is here to help your business — and your employees — thrive

Find out how our experienced team can help you build a benefits plan that truly fits your business's needs.

Important Disclosures and Information

Workplace Benefits is the institutional retirement and benefits business of Bank of America Corporation ("BofA Corp.") operating under the name "Bank of America." Investment advisory and brokerage services are provided by wholly owned non-bank affiliates of BofA Corp., including Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as "MLPF&S" or "Merrill"), a dually registered broker-dealer and investment adviser and Member SIPC. Banking activities may be performed by wholly owned banking affiliates of BofA Corp., including Bank of America, N.A., Member FDIC.

Bank of America, Merrill, their affiliates and advisors do not provide legal, tax or accounting advice. Consult your own legal and/or tax advisors before making any financial decisions. Any informational materials provided are for your discussion or review purposes only. The content on the Center for Business Empowerment (including, without limitations, third party and any Bank of America content) is provided “as is” and carries no express or implied warranties, or promise or guaranty of success. Bank of America does not warrant or guarantee the accuracy, reliability, completeness, usefulness, non-infringement of intellectual property rights, or quality of any content, regardless of who originates that content, and disclaims the same to the extent allowable by law. All third party trademarks, service marks, trade names and logos referenced in this material are the property of their respective owners. Bank of America does not deliver and is not responsible for the products, services or performance of any third party.

Not all materials on the Center for Business Empowerment will be available in Spanish.

Certain links may direct you away from Bank of America to unaffiliated sites. Bank of America has not been involved in the preparation of the content supplied at unaffiliated sites and does not guarantee or assume any responsibility for their content. When you visit these sites, you are agreeing to all of their terms of use, including their privacy and security policies.

Credit cards, credit lines and loans are subject to credit approval and creditworthiness. Some restrictions may apply.

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S" or “Merrill") makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (“BofA Corp."). MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC, and a wholly owned subsidiary of BofA Corp.

Banking products are provided by Bank of America, N.A., and affiliated banks, Members FDIC, and wholly owned subsidiaries of BofA Corp.

“Bank of America” and “BofA Securities” are the marketing names used by the Global Banking and Global Markets division of Bank of America Corporation. Lending, derivatives, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Trading in securities and financial instruments, and strategic advisory, and other investment banking activities, are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, BofA Securities, Inc., which is a registered broker-dealer and Member of SIPC, and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. is a registered futures commission merchant with the CFTC and a member of the NFA.

Investment products: