How do employers choose and set up a workplace retirement plan?

June 9, 2025 | 3 minute read

Choosing a new plan or enhancing the one you already have

Whether you’ve never offered a retirement plan before or are looking to enhance the one you already have, there are a number of factors to consider when searching for the right option for your business.

Here are the three most common types of workplace retirement plans offered by small businesses. For more details, check out an in-depth comparison of each or try our Retirement Account Selector Tool.

401(k) — A 401(k) can be a good choice for many small businesses and self-employed individuals. They are easy to set up online and all have contribution limits three times higher than those of traditional IRAs.1

- Streamlined, three-step online setup makes establishing a 401(k) quick and simple

- Online administration that's straightforward and easy to manage helps reduce your administrative burden

- Employer, employees or both can contribute

- High contribution limits and additional catch-up contributions for participants age 50+2

- Contributions you make are generally tax-deductible by your business3

- A menu of funds and model portfolios takes the guesswork out of investing4,5

SIMPLE IRA—A Savings Incentive Match Plan for Employees (SIMPLE) IRA is a cost-effective, low-maintenance plan for businesses that don't have a ton of employees. You make contributions for your employees, who can also contribute through salary deferrals.

- Easy online application and administration

- Employers must contribute; employee contribution is optional

- Contributions you make are generally tax-deductible by your business6

- Participants can contribute significantly more than they could with a traditional IRA7

SEP IRA — A Simplified Employee Pension (SEP) IRA is an inexpensive and easy-to-establish plan for individuals and small businesses that don't have a ton of employees.

- Easy online application and administration

- Only employers can contribute

- Contribute nearly 10x more than to a traditional IRA8

- Contributions you make are generally tax-deductible by your business9

To learn more about which retirement plan is right for you, visit Workplace Benefits for Business Owners and Entrepreneurs.

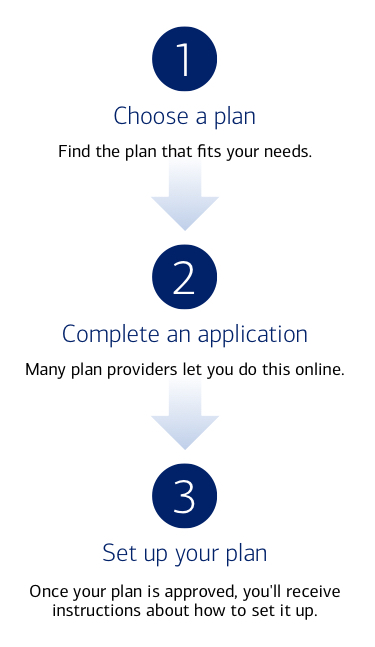

How to set up a workplace retirement plan

While establishing a workplace retirement plan may seem daunting, it's actually not a difficult process.

Here's how it usually works:

Bank of America Workplace Benefits™ for small business owners and entrepreneurs

Find out how our experienced team can help you build a benefits plan that truly fits your business's needs.

How can employers boost employee engagement in workplace retirement plans?

Getting your employees to enroll and contribute is the final piece of the puzzle. We’ll show you how to do it successfully.

Bank of America Workplace Benefits™ is here to help your business — and your employees — thrive

Find out how our experienced team can help you build a benefits plan that truly fits your business's needs.

1 www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000

2 See note 1, above.

3 For more information visit the IRS website. You should talk to your legal and/or tax advisors before making any financial decisions.

4 Plan- and participant-level administrative and recordkeeping services for Merrill Small Business 401(k) plans are provided by Ascensus. Investment advisory and fiduciary services are provided by Morningstar Investment Management LLC, a registered investment advisor and wholly owned subsidiary of Morningstar, Inc. Morningstar Investment Management LLC is a provider of investment management solutions, including investment advisory and retirement plan services. Educational call center support will be provided by Ascensus. Bank of America Corporation, Ascensus and Morningstar Investment Management LLC are not affiliated.

5 Morningstar Investment Management LLC selects the investments and is responsible for the ongoing monitoring and maintenance of the investments and model portfolios. Merrill is responsible for ongoing product management and vendor oversight, as well as trading and custodial services of plan assets and monthly transaction statements.

6 See note 3, above.

7 Contribution and compensation limits are subject to a cost-of-living adjustment annually pursuant to the Internal Revenue Code. Contribution and compensation limits for subsequent years may vary.

8 As the business owner, your contributions to your SEP IRA account and deductions for such contributions may vary based on your net earnings and self-employment tax deduction. Please consult your tax advisor.

9 See note 3, above.

Important Disclosures and Information

Bank of America, Merrill, their affiliates and advisors do not provide legal, tax or accounting advice. Consult your own legal and/or tax advisors before making any financial decisions. Any informational materials provided are for your discussion or review purposes only. The content on the Center for Business Empowerment (including, without limitations, third party and any Bank of America content) is provided “as is” and carries no express or implied warranties, or promise or guaranty of success. Bank of America does not warrant or guarantee the accuracy, reliability, completeness, usefulness, non-infringement of intellectual property rights, or quality of any content, regardless of who originates that content, and disclaims the same to the extent allowable by law. All third party trademarks, service marks, trade names and logos referenced in this material are the property of their respective owners. Bank of America does not deliver and is not responsible for the products, services or performance of any third party.

Not all materials on the Center for Business Empowerment will be available in Spanish.

Certain links may direct you away from Bank of America to unaffiliated sites. Bank of America has not been involved in the preparation of the content supplied at unaffiliated sites and does not guarantee or assume any responsibility for their content. When you visit these sites, you are agreeing to all of their terms of use, including their privacy and security policies.

Credit cards, credit lines and loans are subject to credit approval and creditworthiness. Some restrictions may apply.

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (“BofA Corp.”). MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC, and a wholly owned subsidiary of BofA Corp.

Banking products are provided by Bank of America, N.A., and affiliated banks, Members FDIC, and wholly owned subsidiaries of BofA Corp.

“Bank of America” and “BofA Securities” are the marketing names used by the Global Banking and Global Markets division of Bank of America Corporation. Lending, derivatives, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Trading in securities and financial instruments, and strategic advisory, and other investment banking activities, are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, BofA Securities, Inc., which is a registered broker-dealer and Member of SIPC, and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. is a registered futures commission merchant with the CFTC and a member of the NFA.

Investment products: