How can employers boost employee engagement in workplace retirement plans?

June 9, 2025 | 5 minute read

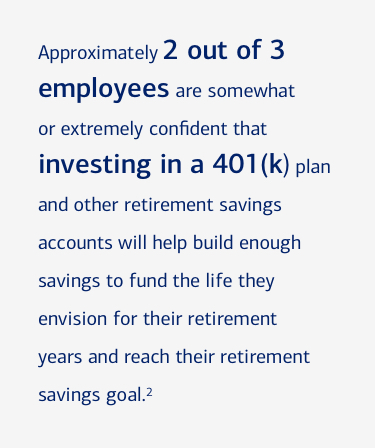

A majority of employees think saving for retirement is a high priority1

Chances are most of your employees keep retirement high on their list of financial priorities. And as their employer, you’re uniquely positioned to help them make progress toward their retirement savings goals. Not only by offering a workplace retirement plan, but by making sure they understand all the ways getting actively involved in preparing for their financial futures can benefit them.

Preparing for tomorrow can provide potential benefits today

Of course contributing to a workplace retirement plan will help employees in the future. But there are also plenty of benefits employees can enjoy right now.3

- Employee contributions can reduce current taxable income.

- Pre-tax contributions and any investment gains are not taxed until distributed.

- Contributions are easy to make through payroll deductions.

- Retirement assets can be carried from one employer to another.

- The saver's credit may be available to some employees.

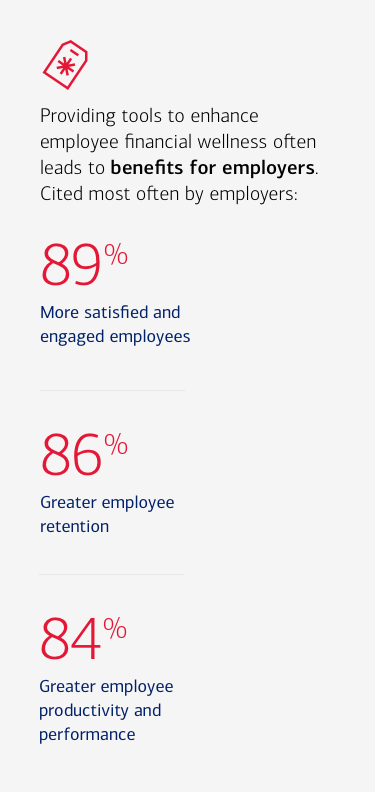

Promoting financial wellness

Nearly 90% of plan sponsors believe providing financial wellness tools leads to greater employee satisfaction, retention and productivity.4 That’s why offering your employees financial wellness insights and education is a smart move for your business.

Source: 2025 Bank of America Workplace Benefits Report Survey

And while most small companies feel extremely or somewhat responsible for their employees’ financial wellness, fewer than half offer financial wellness programs.5

Source: 2025 Bank of America Workplace Benefits Report Survey

To help you offer financial wellness education to your employees, there are a number of informative, effective tools and resources available. Some of these tools include:

- The Benefits OnLine® Education Center, an online resource providing content that covers a wide spectrum of needs, spanning from in-depth reads to quick videos.

- Better Money Habits®, a free, easy-to-use educational hub that can help employees achieve their financial goals with articles, videos and tips.

- Integrated accounts to give your employees a clear view of their broad financial picture across banking6 and investing,7 all in one place.

With the right program, you can then create a strategic communications plan to boost employee knowledge, enrollment and engagement.

Other benefit solutions to consider

With additional benefits offerings, you can create a holistic benefits program to help keep your employees healthy, happy and more financially prepared.

Health savings account (HSA)8—An HSA allows your eligible employees to save pre-tax dollars for future health care expenses. It works with all HSA-eligible health plans that typically offer lower monthly premiums than traditional health insurance plans, thereby saving you and your employees money.

Flexible spending account (FSA)—An FSA enables employees to set aside pre-tax dollars to help pay for qualified medical expenses that occur during a particular year.

Health reimbursement arrangement (HRA)—An HRA lets you fund accounts for your employees to help them pay for qualified medical expenses not covered by their health plans. It can be paired with an FSA.

Lifestyle spending account (LSA)—An LSA lets you design a customized post-tax benefit for your employees that promotes healthy habits and overall well-being. Funds in an LSA can typically be used for things like gym memberships, retreats, personal development courses, spa services and even utility bills.

Commuter benefits—This valuable benefit allows employees to set aside pre-tax dollars to pay for expenses related to commuting to and from work—including mass transit, vanpooling and work-related parking.

Bank of America Workplace Benefits™ for small business owners and entrepreneurs

Find out how our experienced team can help you build a benefits plan that truly fits your business's needs.

Retirement planning tips for business owners

Explore your exit strategies and prepare financially for life after business.

Employee benefits guide for small business owners

Questions about what benefits to offer your employees? You'll find answers here.

Bank of America Workplace Benefits™ is here to help your business — and your employees — thrive

Find out how our experienced team can help you build a benefits plan that truly fits your business's needs.

1 2025 Bank of America Workplace Benefits Report Survey.

2 See note 1, above.

3 www.irs.gov/retirement-plans/plan-sponsor/benefits-of-setting-up-a-retirement-plan

4 See note 1, above.

5 See note 1, above.

6 Investment products are available from Merrill Lynch, Pierce, Fenner & Smith Incorporated.

7 Bank products are available from Bank of America, N.A., and affiliated banks.

8 Bank of America, N.A. makes available The HSA for Life® Health Savings Account as a custodian only. The HSA for Life is intended to qualify as a Health Savings Account (HSA) as set forth in Internal Revenue Code section 223. However, the account beneficiary establishing the HSA is solely responsible for ensuring satisfaction of eligibility requirements set forth in IRC sec 223. If an individual/employee establishes a HSA and s/he is not otherwise eligible, s/he will be subject to adverse tax consequences. In addition, an employer making contributions to the HSA of an ineligible individual may also be subject to tax consequences. We recommend that applicants and employers contact qualified tax or legal counsel before establishing a HSA. Bank of America does not sponsor or maintain the Flexible Spending Accounts (FSA)/Health Reimbursement Accounts (HRA) that you establish. The programs are sponsored and maintained solely by the employer offering the plan, or by an individual establishing an independent plan. Bank of America acts solely as claims administrator performing administrative tasks pursuant to an agreement with, and at the direction of, the sponsoring employer or individual under an independent plan. The sponsoring employer or individual under an independent plan is solely responsible for ensuring such arrangements comply with all applicable laws.

Important Disclosures and Information

Workplace Benefits is the institutional retirement and benefits business of Bank of America Corporation ("BofA Corp.") operating under the name "Bank of America." Investment advisory and brokerage services are provided by wholly owned non-bank affiliates of BofA Corp., including Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as "MLPF&S" or "Merrill"), a dually registered broker-dealer and investment adviser and Member SIPC. Banking activities may be performed by wholly owned banking affiliates of BofA Corp., including Bank of America, N.A., Member FDIC.

Bank of America, Merrill, their affiliates and advisors do not provide legal, tax or accounting advice. Consult your own legal and/or tax advisors before making any financial decisions. Any informational materials provided are for your discussion or review purposes only. The content on the Center for Business Empowerment (including, without limitations, third party and any Bank of America content) is provided “as is” and carries no express or implied warranties, or promise or guaranty of success. Bank of America does not warrant or guarantee the accuracy, reliability, completeness, usefulness, non-infringement of intellectual property rights, or quality of any content, regardless of who originates that content, and disclaims the same to the extent allowable by law. All third party trademarks, service marks, trade names and logos referenced in this material are the property of their respective owners. Bank of America does not deliver and is not responsible for the products, services or performance of any third party.

Not all materials on the Center for Business Empowerment will be available in Spanish.

Certain links may direct you away from Bank of America to unaffiliated sites. Bank of America has not been involved in the preparation of the content supplied at unaffiliated sites and does not guarantee or assume any responsibility for their content. When you visit these sites, you are agreeing to all of their terms of use, including their privacy and security policies.

Credit cards, credit lines and loans are subject to credit approval and creditworthiness. Some restrictions may apply.

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S" or “Merrill") makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (“BofA Corp."). MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC, and a wholly owned subsidiary of BofA Corp.

Banking products are provided by Bank of America, N.A., and affiliated banks, Members FDIC, and wholly owned subsidiaries of BofA Corp.

“Bank of America” and “BofA Securities” are the marketing names used by the Global Banking and Global Markets division of Bank of America Corporation. Lending, derivatives, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Trading in securities and financial instruments, and strategic advisory, and other investment banking activities, are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, BofA Securities, Inc., which is a registered broker-dealer and Member of SIPC, and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. is a registered futures commission merchant with the CFTC and a member of the NFA.

Investment products: