When asked to grade healthcare’s journey to digital, Assistant Treasurer for Cash Management at Kaiser Permanente, Sheila Stephens, says, “I would rank it a six out of ten. Many organizations have moved to mobile apps and are setting up portals. We’re trying to reach both vendors and patients to reduce paper.” Treasury Managing Director and Assistant Treasurer at Cigna, Scott Lambert, agrees, saying, “I also give a rating of six. Yes, there’s a lot of paper but there’s also been great progress over the past 10 years, accelerated by the pandemic.” Head of Global Commercial Banking for Global Transaction Services at Bank of America, Sue Caras, adds, “I give it a five, but I have full confidence that it will improve. It’s not surprising that the healthcare market is still paper-intensive because it’s one of the most complex payments ecosystems — it’s not just about payments, it’s about the secure flow of sensitive health information.”

What will it take for healthcare to fully embrace digital?

February 27, 2024 | 9 minute read

Key takeaways

- In a time of rapid innovation, healthcare is behind the digital curve

- Roadblocks include patient and member hesitancy, data concerns and a lack of standardization across healthcare systems

- The way forward will leverage emerging technology from many sources, coupled with targeted outreach and continued patient education

Where is the industry on its journey?

What needs to happen to accelerate the transformation?

Healthcare involves a lot of regulatory documentation, and the adoption of digital signatures and electronic notary services by state and federal governments has been a big step forward. Fintech vendors are also playing a key role. Lambert says, “We’re using fintech to get to that last mile. If you’re only receiving a few payments or claims from us, it’s good having fintech vendors who can act as intermediaries between payers and providers.”

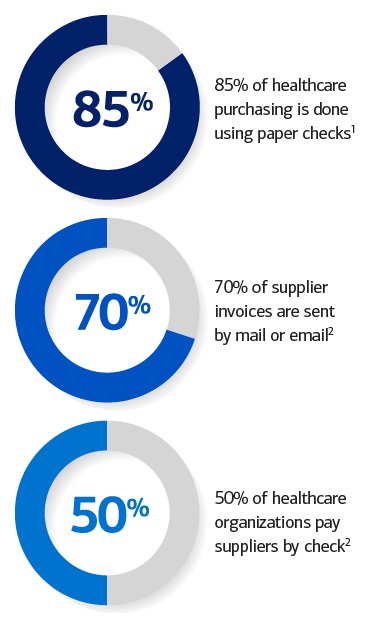

“Manual paper-based processes add $22 billion in unnecessary annual expenses in the healthcare industry.”1

But fintech also raises integration issues. Caras says, “At Bank of America, we’ve found that it’s challenging for healthcare systems to integrate off-the-shelf fintech solutions into an existing platform they’ve spent millions of dollars building. The question then becomes, how do we operate within the patient accounting software platforms that clients already have, without adding undue complexity through bolt-ons and additional vendor management responsibilities?” The ideal situation is a modernized healthcare business model with the potential to integrate other solutions. Caras adds, “I’d like to see a system where patients can arrive at their visit prepaid and preregistered, and afterward can view their test results, receive a comprehensive but clear Explanation of Benefits from their insurance company, and pay any excess amount with their mobile wallet. That’s nirvana for me, rather than creating a siloed tech standalone solution.”

Identifying and clearing roadblocks

Treasurers today act as strategic advisors in driving decisions that can help with the transition from paper to electronic. Lambert says, “We’re looking at payment optimization across the enterprise. We see where the company is issuing checks and set up meetings with senior leadership to discuss costs and customer benefits, then get buy-in to build a business case for digital.”

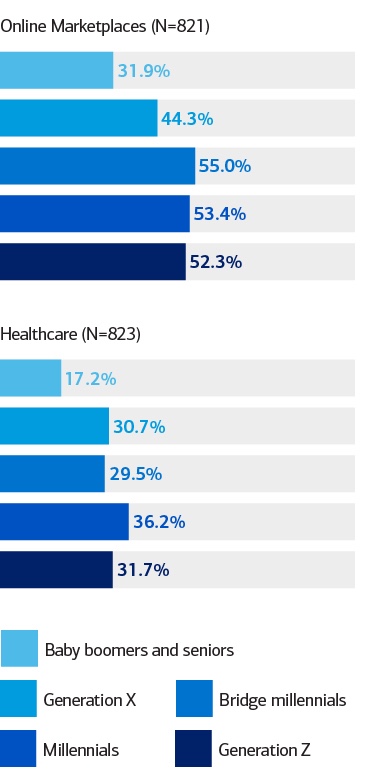

Often the roadblocks encountered are more to do with the patient experience. When providers pivoted to telemedicine during the pandemic, patients quickly adapted, but there wasn’t the same enthusiasm on the payments side. As Stephens says, “What happens if you don’t understand a bill, or don’t trust that your data is secure? Our task is getting those members to a better place. We need to educate everyone in communities and across generations.”

Comfort level with digital healthcare payments varies by generation and platform

Share of consumers who store payment credentials

Standardization is another important issue. How can a format that everyone agrees upon be achieved for digital, so experiences are seamless across different healthcare systems? According to Caras, “We need everyone on board. The big players, the family practices, the pharmacies.” But it’s a big ask and the push may need to come from government. Lambert says, “We already have some standard processes driven by the government via legislative action. Maybe continued government intervention is what it takes to go further.” Stephens agrees: “If you don’t have a 100-person IT department, perhaps you’ll need incentives. Additional government and regulatory intervention could be the push that’s needed.”

Steps to take now

While full standardization may be years away, what can the industry do now? Many organizations are hiring digital technology officers to improve the patient experience. This may include upgrading systems to enable digital collections remitted through mobile wallets, and emerging payments technology. It also extends to an increased mindfulness of the user interfaces that drive a patient’s post-care financial journey, as these directly impact net promoter scores.

Stephens believes the key is data, outreach and education: “If you start doing analytics, you can home in on who is continuing to send checks. Why do they do that and how can we change their behavior?” But, given how all generations switched to digital during the pandemic, for consumers it’s perhaps less to do with how to do digital and more to do with how to get comfortable with it in healthcare.

What comes next?

The journey to digital is well underway, which is good news for budgets, ESG goals and the patient experience. But getting to the next step means embracing all aspects of digital — from video visits to paying via a portal — by communicating the benefits to patients and providers alike. While digital is still a work in progress, at Bank of America, we’re driving change for healthcare clients by helping them move to a paperless environment through the latest technology and practices. It’s part of our ongoing commitment to making business easier.

Explore more

Future of healthcare payments

New platforms are making it safer, easier and more convenient for patients to pay for care while also allowing for faster bill collection.

The expanding benefits of digital payments

More tech-savvy consumers, combined with an increased focus on digital security and convenience by buyers and sellers, is broadening demand for digital payments.

Important Disclosures and Information

Bank of America, Merrill, their affiliates and advisors do not provide legal, tax or accounting advice. Consult your own legal and/or tax advisors before making any financial decisions. Any informational materials provided are for your discussion or review purposes only. The content on the Center for Business Empowerment (including, without limitations, third party and any Bank of America content) is provided “as is” and carries no express or implied warranties, or promise or guaranty of success. Bank of America does not warrant or guarantee the accuracy, reliability, completeness, usefulness, non-infringement of intellectual property rights, or quality of any content, regardless of who originates that content, and disclaims the same to the extent allowable by law. All third party trademarks, service marks, trade names and logos referenced in this material are the property of their respective owners. Bank of America does not deliver and is not responsible for the products, services or performance of any third party.

Not all materials on the Center for Business Empowerment will be available in Spanish.

Certain links may direct you away from Bank of America to unaffiliated sites. Bank of America has not been involved in the preparation of the content supplied at unaffiliated sites and does not guarantee or assume any responsibility for their content. When you visit these sites, you are agreeing to all of their terms of use, including their privacy and security policies.

Credit cards, credit lines and loans are subject to credit approval and creditworthiness. Some restrictions may apply.

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (“BofA Corp.”). MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC, and a wholly owned subsidiary of BofA Corp.

Banking products are provided by Bank of America, N.A., and affiliated banks, Members FDIC, and wholly owned subsidiaries of BofA Corp.

“Bank of America” and “BofA Securities” are the marketing names used by the Global Banking and Global Markets division of Bank of America Corporation. Lending, derivatives, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Trading in securities and financial instruments, and strategic advisory, and other investment banking activities, are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, BofA Securities, Inc., which is a registered broker-dealer and Member of SIPC, and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. is a registered futures commission merchant with the CFTC and a member of the NFA.

Investment products: