Maximizing employee retention is one of the best ways to make sure your small business thrives. Unfortunately, staying fully staffed can be challenging in today’s business environment. According to the 2025 Bank of America Business Owner Report conducted in partnership with Bank of America Institute, 40% of small businesses say labor shortages are a top concern.

8 employee retention strategies for small business owners

January 8, 2026 | 5 minute read

What is employee retention?

Employee retention refers to the strategies and processes you can use to hold on to your workers and minimize turnover. Many businesses strive to retain employees by creating a positive workplace culture, promoting engagement, expressing appreciation to employees for their contributions, making sure their pay and benefits are competitive, and promoting a healthy work-life balance.

Why is it important for small businesses to retain their employees?

Retaining employees can help you avoid the disruptions that come with having to find replacements when they leave. You also don’t incur onboarding and training costs if your existing staff stays in place. According to the Society for Human Resource Management (SHRM), replacing an employee can cost between 50% and 200% of their annual salary. That means if someone earns $50,000, the cost of replacing that employee could range from $25,000 to $100,000.1

Other benefits of employee retention for small business owners include:

- Higher productivity. When employees leave, it can take a while for their replacements to match their output.

- Better morale. Staying fully staffed may decrease the risk of employee burnout since you avoid putting additional pressure on your existing team.

- A more consistent customer experience. If you’re working with a skeleton crew, customer service and satisfaction may deteriorate.

- A vibrant culture. Many employees enjoy coming to work because they’ve become friends with their teammates — and if these friends leave, work may be less inviting to them.

- Better profitability. Thanks to the higher productivity and lower hiring expenses that come with a stable team, many small business owners find that higher retention rates protect profits.

Common reasons employees leave their jobs

Retaining employees starts with being sensitive to their concerns and responding to them before you find yourself in an exit interview. Here are some common reasons employees quit:

- Compensation/benefits. Low pay is one of the top reasons workers give for quitting their jobs, according to a recent survey by iHire, an online recruiting company.2 More than 20% of workers cited this as a reason for leaving a job in the past year.

- Lack of opportunities for advancement. In addition, 18% of workers who quit their jobs said not having enough professional development activities was a top reason, and 15% said there weren’t enough opportunities for advancement, the iHire survey found.2

- Bad managers. A company’s leadership team can drive employees to leave. The iHire survey found that 28% of employees who left a job in the past year did so because they were unhappy with a manager or supervisor, while 30% were unhappy with company leadership overall.2

- Not enough flexibility. According to the iHire survey, 21% of employees cited poor work-life balance as a reason they quit.2

- Workload. Being overloaded can contribute to work-related stress and burnout, according to the Mayo Clinic.3 Burnout can also be a big motivation for quitting. One survey by employment company MyPerfectResume found that one in five employees think about quitting their job every day.4

- Lack of recognition. This can contribute to dissatisfaction in many employees, according to research from Gallup.5

8 approaches to improving employee retention

1. A thoughtful, intentional onboarding process

Don’t cut corners when it comes to onboarding new hires. Your process for welcoming and acculturating newbies will set the tone for their experience afterward.

2. Promotions and professional development

Promoting from within shows employees that there are advancement opportunities at the company. Regularly discussing their career goals with them and providing access to professional development opportunities and coaching can improve not only productivity but also loyalty.

3. Competitive pay and perks

Evaluate pay regularly to make sure you’re offering competitive compensation or other incentives, like bonuses or revenue sharing. You can also offer valued perks, such as remote work options.

4. Public recognition

Being acknowledged for their contributions is a top priority for many employees. Regularly showing appreciation of their hard work, whether with a casual comment in a meeting or a formal “employee of the month” award, sends the message that hard work is appreciated.

5. Work-life balance and flexibility

Many employees seek a healthy work-life balance and want managers to respect their lives outside of work. That means making sure there are boundaries to the workday while also offering flexible work schedules.

6. Constant communication and continuous feedback

Employees will have a greater sense of purpose if you keep them in the loop on the business’s key goals and initiatives and how they can play a part. Making time for one-on-one meetings where you discuss short- and long-term goals and provide feedback can deepen your relationship with your team.

7. Opportunity and inclusion

Employees who feel accepted and valued as individuals report higher levels of work satisfaction and engagement. Key ways to create an inclusive environment include promoting pay equity, providing career development, acknowledging cultural holidays and encouraging open communication.

8. Teamwork

Encourage collaboration among your employees and introduce regular team-building activities.

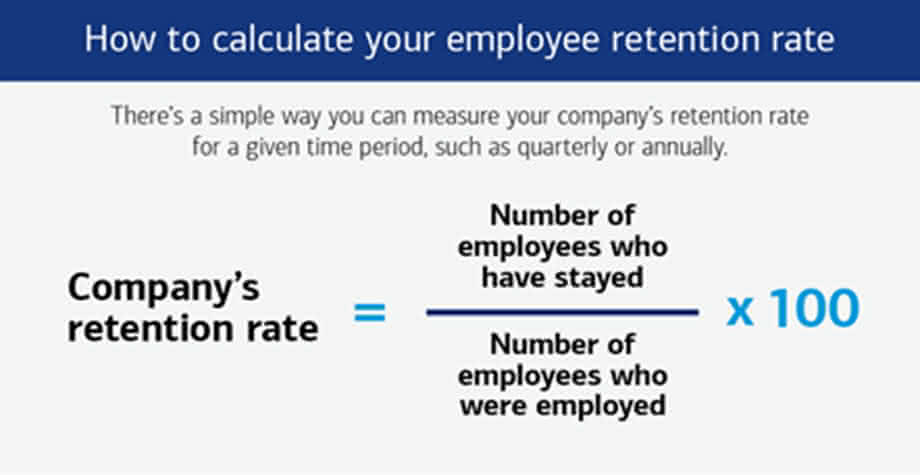

How to calculate your employee retention rate

There’s a simple way you can measure your company’s retention rate for a given period, such as quarterly or annually.

- Divide the number of employees who have stayed by the number who were employed at a given time. For instance, let’s say you have 40 employees on January 1. Five team members leave by the end of the first quarter, and 35 have stayed. If you divide 35 by 40, you get 0.875.

- Multiply that by 100 and you get an 87.5% retention rate for that quarter.

Trade publications in your industry can give you a sense of the average retention rate in your industry, so you know if there’s room for improvement.

1 SHRM, “The Myth of Replaceability: Preparing for the Loss of Key Employees,” January 21, 2025.

2 iHire, “Talent Retention Report 2024,” December 2024.

3 Mayo Clinic, “Job burnout: How to spot it and take action,” November 30, 2023.

4 MyPerfectResume, “Employee Burnout Survey Finds 1 in 5 Workers Think About Quitting Their Job Daily,” March 2025.

5 Gallup and Workhuman, “From ‘Thank You’ to Thriving: A Deeper Look at How Recognition Amplifies Wellbeing,” May 18, 2023.

Explore more

Know the rules before hiring your first employee

The decision to hire a full-time employee can be both exhilarating and nerve-wracking. Here are the things that should be top of mind when starting to hire.

Employee benefits guide for small business owners

Questions about what benefits to offer your employees? You'll find answers here.

Important Disclosures and Information

Bank of America, Merrill, their affiliates and advisors do not provide legal, tax or accounting advice. Consult your own legal and/or tax advisors before making any financial decisions. Any informational materials provided are for your discussion or review purposes only. The content on the Center for Business Empowerment (including, without limitations, third party and any Bank of America content) is provided “as is” and carries no express or implied warranties, or promise or guaranty of success. Bank of America does not warrant or guarantee the accuracy, reliability, completeness, usefulness, non-infringement of intellectual property rights, or quality of any content, regardless of who originates that content, and disclaims the same to the extent allowable by law. All third party trademarks, service marks, trade names and logos referenced in this material are the property of their respective owners. Bank of America does not deliver and is not responsible for the products, services or performance of any third party.

Not all materials on the Center for Business Empowerment will be available in Spanish.

Certain links may direct you away from Bank of America to unaffiliated sites. Bank of America has not been involved in the preparation of the content supplied at unaffiliated sites and does not guarantee or assume any responsibility for their content. When you visit these sites, you are agreeing to all of their terms of use, including their privacy and security policies.

Credit cards, credit lines and loans are subject to credit approval and creditworthiness. Some restrictions may apply.

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (“BofA Corp.”). MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC, and a wholly owned subsidiary of BofA Corp.

Banking products are provided by Bank of America, N.A., and affiliated banks, Members FDIC, and wholly owned subsidiaries of BofA Corp.

“Bank of America” and “BofA Securities” are the marketing names used by the Global Banking and Global Markets division of Bank of America Corporation. Lending, derivatives, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Trading in securities and financial instruments, and strategic advisory, and other investment banking activities, are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, BofA Securities, Inc., which is a registered broker-dealer and Member of SIPC, and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. is a registered futures commission merchant with the CFTC and a member of the NFA.

Investment products: