How much is my business worth? A guide to business valuation

August 4, 2025 | 6 minute read

Key takeaways:

- Knowing the value of your business can help you prepare for a company sale, transfer to family members or planning your estate.

- Deciding which valuation method is best depends on the size and type of your business, and the reasons you’re looking for a valuation.

- Market conditions, industry trends and unique business circumstances can also affect how much your business is worth.

Whether you’re preparing to sell your company, buy out a partner’s shares or craft an estate plan, a critical factor in executing against your goal is answering this question: How much is my business actually worth? But there are multiple methods for calculating the value of a business, and the one you choose should be driven by the reasons why you are seeking a valuation and the type of business you are trying to value.

That’s why getting a professional valuation based on your goals is so important — you don’t want to either overvalue or undervalue your business. “I used to think that owners might overvalue their businesses,” says Thomas Pavlick, regional market executive at Bank of America’s Global Commercial Investment Bank. “But many business owners tend to undervalue their enterprises before they get an actual evaluation.”

Key questions to ask when valuing your business:

Why are you seeking a valuation?

Your goals — looking for a buyer, estate planning, management restructuring — should drive the type of business valuation you use.

Which method matches your goals?

Owners looking to sell their business may find the earnings multiplier method the most accurate. If you’re valuing your business for estate planning purposes, then the discounted cash flow method may be worth considering.

How much will it cost?

Many business owners looking to sell don’t realize that an investment banker will do a thorough valuation as part of the sale process for no extra fee.

Is your paperwork in order?

You’ll need at least three years’ worth of financial, customer and supplier information.

Do you have special circumstances?

Do you have a concentrated customer base? If you walked out tomorrow, would there be a team in place to take over? Is your industry currently “hot” or out of favor? All these factors can affect the value of your business.

Matching valuation method to goals

Preparing for a sale is one of the most common reasons business owners seek to obtain a valuation. Nearly six in 10 plan to exit their companies by 2027, including 71% of baby boomers and 48% of millennial owners looking to sell, transfer, gift or close their business in the near term, according to Bank of America data.

But there are other reasons, too. Owners may be looking for investors to fund an expansion. Or they may need to value a closely held business as part of their trust and estate planning. Others may be changing the ownership structure of a business, such as buying out a partner who is ready to retire or dealing with a family member who wants to sell shares.

A valuation will give business owners a good sense of what they will gain after the sale, which can be used for retirement savings or other goals. A Bank of America business specialist can help owners estimate what the sales proceeds will be minus the fees from consultants and other expenses related to the sale.

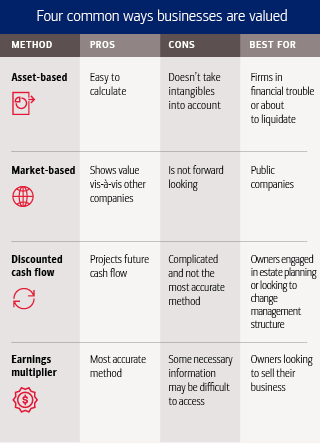

Here are four of the most common valuation methods and the situations they may be best suited for:

1. Asset-based valuations:

This method involves taking the fair market value of a company’s hard assets, such as equipment and buildings, minus its liabilities to arrive at the value of the business. This is the simplest valuation method, and it doesn’t include subjective factors that can affect a business’s value, such as market or industry conditions. As a result, it’s best used for businesses facing financial troubles or liquidation, when an owner needs to determine the value of hard assets. Lenders sometimes also use this method in deciding loans that use a company’s assets as collateral.

2. Market-based valuations:

This method compares the financial metrics of one company with similar public companies to come up with a fair-market valuation. Market-based valuations are usually limited to publicly listed companies that issue quarterly financial statements and information about their finances, such as price-to-earnings ratios, is available. This method doesn’t take into consideration the intangibles that can affect the future of a business.

3. Discounted cash-flow:

The value in this method is found using expected future cash flows and then discounting them back to their present value. This is by far the most complicated method and relies on projections of how much money the business will generate in the future. However, the discounted cash flow approach may be best for estate planning purposes, when you’ll want a look at what the business could be worth to heirs in the future and what the tax implications may be.

4. Earnings multiplier:

For small and midsize businesses, this is the most common valuation method used by investment banks to decide what a company would be worth if it is sold and is based on the profitability of the company. It uses earnings before interest, taxes, depreciation and amortization (EBITDA) and applies a multiple that is determined by comparing a business with recent sales of comparable firms in the same industry. Often, this information is only available in non-public databases, which is why it’s important to enlist a banker with access to a wide range of proprietary information to make the assessment. A bonus is that most banks figure out the valuation as part of their due diligence process and don’t charge extra for the valuation.

Market conditions

Regardless of the valuation method used, general economic conditions and industry-specific trends can have a significant impact on business valuations, says Pavlick. That’s something that owners need to be aware of, especially if they are looking to sell their businesses.

Shortly into the COVID-19 pandemic in 2021, the mergers and acquisitions market took off, says Pavlick, fueled by low interest rates and pent-up demand. “Valuations for all types and sizes of companies were as high as they’d ever been,” he says. Since then, higher interest rates slowed deals down and made valuations more difficult to calculate.

Subjective considerations

When seeking a valuation, you can’t ignore intangible issues that may apply to an individual business or specific industry.

If your business is a government contractor, for instance, certain designations, such as a veteran-owned business, a women-owned business, or a minority-owned business, may have special access to certain contracts. But if you plan to sell to a buyer who does not have such status, the business is not entitled to the special designation and a large part of your revenues might disappear, significantly affecting your company’s value.

An overdependence on any single customer also can be a problem. Having one customer accounting for more than 20% of your business is often considered a red flag. The broader your customer base, the higher your valuation may be.

Management concentration is another concern. If most of a company’s revenues are dependent on the owner, and the owner leaves, then there isn’t much value left for a potential buyer. Pavlick cites the example of a successful plastic surgeon practice in which the owner has achieved an almost star-like status among a loyal and high-paying clientele, but when the owner leaves, the star power also recedes.

Finally, industry trends cannot be ignored. The valuation process almost always begins by using a standard industry multiple. But that number can vary widely depending on what industry you’re in, says Pavlick. A company in a hot industry can sell at a much higher multiple than other businesses.

Best practices

There are several steps business owners can take to prepare for the valuation process and shine the best light possible on their company, says Pavlick. Here’s what he suggests:

- Start early. Most owners looking to sell should start the process at least three years in advance. That way you’ll have time to bolster your finances and management structure and let any swings in the M&A market to play out. You’ll have the flexibility to build value and time your sale at the optimum moment for you.

- Don’t overpay. Often a business owner will automatically turn to a CPA or business valuation firm to conduct a valuation. In many cases, this works fine. But if you’re planning to sell your business, keep in mind that an investment banking firm will automatically do a valuation for no extra charge. These bankers also have access to the essential information necessary for a valuation, including recent deals in the same industry with similar companies.

- Broaden your customer base or management structure. For example, with the star plastic surgeon, an investment banker or adviser can help guide that business to hire more doctors, and market their popularity to attract a broader audience in a less owner-dependent way. All owners need to make sure another level of management is in place that will boost the value of their business - whether they are passing on to heirs or attracting a potential buyer.

- Get your finances in shape. You’ll need three to five years of financial information, including customers, suppliers, and the growth rate of the firm’s revenue streams. If you find that your company’s earnings growth is trending downward, you’ll need to address that as you prepare for a sale.

Understanding your business’s value puts you in control whether you’re planning to grow, sell or stay the course. A Bank of America business specialist can help you at every stage.

Ready to meet with a specialist?

Our specialists are ready with advice and guidance to help move your business forward.

Estate planning for business owners: How can I plan for my legacy and my business?

Key considerations for building an exit strategy that gives you the future you want – while potentially minimizing estate taxes, disputes among beneficiaries and disruptions to your business.

Important Disclosures and Information

Bank of America, Merrill, their affiliates and advisors do not provide legal, tax or accounting advice. Consult your own legal and/or tax advisors before making any financial decisions. Any informational materials provided are for your discussion or review purposes only. The content on the Center for Business Empowerment (including, without limitations, third party and any Bank of America content) is provided “as is” and carries no express or implied warranties, or promise or guaranty of success. Bank of America does not warrant or guarantee the accuracy, reliability, completeness, usefulness, non-infringement of intellectual property rights, or quality of any content, regardless of who originates that content, and disclaims the same to the extent allowable by law. All third party trademarks, service marks, trade names and logos referenced in this material are the property of their respective owners. Bank of America does not deliver and is not responsible for the products, services or performance of any third party.

Not all materials on the Center for Business Empowerment will be available in Spanish.

Certain links may direct you away from Bank of America to unaffiliated sites. Bank of America has not been involved in the preparation of the content supplied at unaffiliated sites and does not guarantee or assume any responsibility for their content. When you visit these sites, you are agreeing to all of their terms of use, including their privacy and security policies.

Credit cards, credit lines and loans are subject to credit approval and creditworthiness. Some restrictions may apply.

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (“BofA Corp.”). MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC, and a wholly owned subsidiary of BofA Corp.

Banking products are provided by Bank of America, N.A., and affiliated banks, Members FDIC, and wholly owned subsidiaries of BofA Corp.

“Bank of America” and “BofA Securities” are the marketing names used by the Global Banking and Global Markets division of Bank of America Corporation. Lending, derivatives, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Trading in securities and financial instruments, and strategic advisory, and other investment banking activities, are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, BofA Securities, Inc., which is a registered broker-dealer and Member of SIPC, and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. is a registered futures commission merchant with the CFTC and a member of the NFA.

Investment products: