Exit strategies for selling a restaurant franchise

October 30, 2025 | 6 minute read

Key takeaways:

- Franchisees looking to exit their business face specific hurdles that owners of regular businesses don’t have to encounter.

- Starting the planning and sale process early will allow you to integrate your exit with your personal financial planning goals.

- Advice from experienced professionals at key decision points can help you optimize the outcomes for your business as well as you and your family.

All business owners need a thoughtful plan to exit their business that aligns with their personal wealth strategy — at the right time and on their own terms. For franchise owners, having a detailed road map is even more important because of the complexities involved in selling a franchise. Whether your ultimate goal is to enjoy retirement, pursue a new venture or transition ownership to a family member, it can take a little time to all parties aligned and the details right. “Intentional, careful execution will help ensure you maximize value, maintain operational continuity, find a buyer who will pass muster with your franchisor and realize your personal financial goals,” says Valerie Sanger, managing director of Bank of America Global Commercial Banking’s Restaurant Group. Here are some ways to help the process play out in the way you hope.

Start early

Most people think about it to some extent from day one, whether that’s succession planning with their children or growing the business to sell down the road. “It could take nine months to a year to actually exit a business, so whether you’re looking to transfer your business to a family member or to sell, you’ll want to start about a year in advance,” suggests Sanger. Consider: What are the terms of your franchise agreement? What valuation is the current transaction market supporting? Which players in your market are likely to be interested?

Intentional, careful execution will help ensure you maximize value, maintain operational continuity, find a buyer who will pass muster with your franchisor, and realize your personal financial goals.

Work with your franchisor

Historically, some franchise agreements gave the right of first refusal to the brand franchisor. You don't see that often anymore, but at the end of the day, the franchisor does get to approve the buyer. If they don’t want someone as a franchisee, you won’t be able to sell your stores to them.

Some brands get much more involved in that process than others. They may say they want you to sell to a franchisee they view as a good operator who will grow and build new stores. Or you may find a buyer, only to have the brand come back and say no because the proposed buyer is a current franchisee who hasn’t developed the stores as they should have. The franchisor doesn’t have to tell you why they might reject a buyer.

If you own several different brands, most franchisors don’t allow you to own other brands within their franchise entity. So the operator you sell your Arby’s restaurant to is going to be different from the one to whom you sell your Taco Bell or Wendy’s. You would be limiting your buyer pool by saying you have to buy all three brands or nothing. Bear in mind that because different brands are usually owned in different entities, the process will be more complicated and potentially longer if you’re selling multiple brands at the same time.

Get a realistic valuation

Generally, a multiple based on earnings before interest, taxes, depreciation and amortization (EBITDA) will determine valuation. Unfortunately, multiples — and therefore valuation — for a given brand can ebb and flow, so owners sometimes have an unrealistic view of value based on a transaction they heard about or an offer they received some time in the past.

“Ultimately, it’s like the housing market — value is based on what people are willing to pay right now. Often your banker will have a good view of the landscape, so Bank of America, for instance, could be able to share helpful information, like if the last deal that traded in your brand was in that range,” Sanger says. Most owners have a pretty good sense of current multiples for their brand and the value of their business, but that type of recent transaction information can be helpful.

Be aware that significant problems can arise in selling a franchise when an owner has deferred maintenance in anticipation of a sale. Like what happens when selling a house, a buyer inspection can reveal needed repairs and upgrades such as the restaurant air conditioning not functioning properly. The buyer may insist on deducting the cost of the repairs from their original offer.

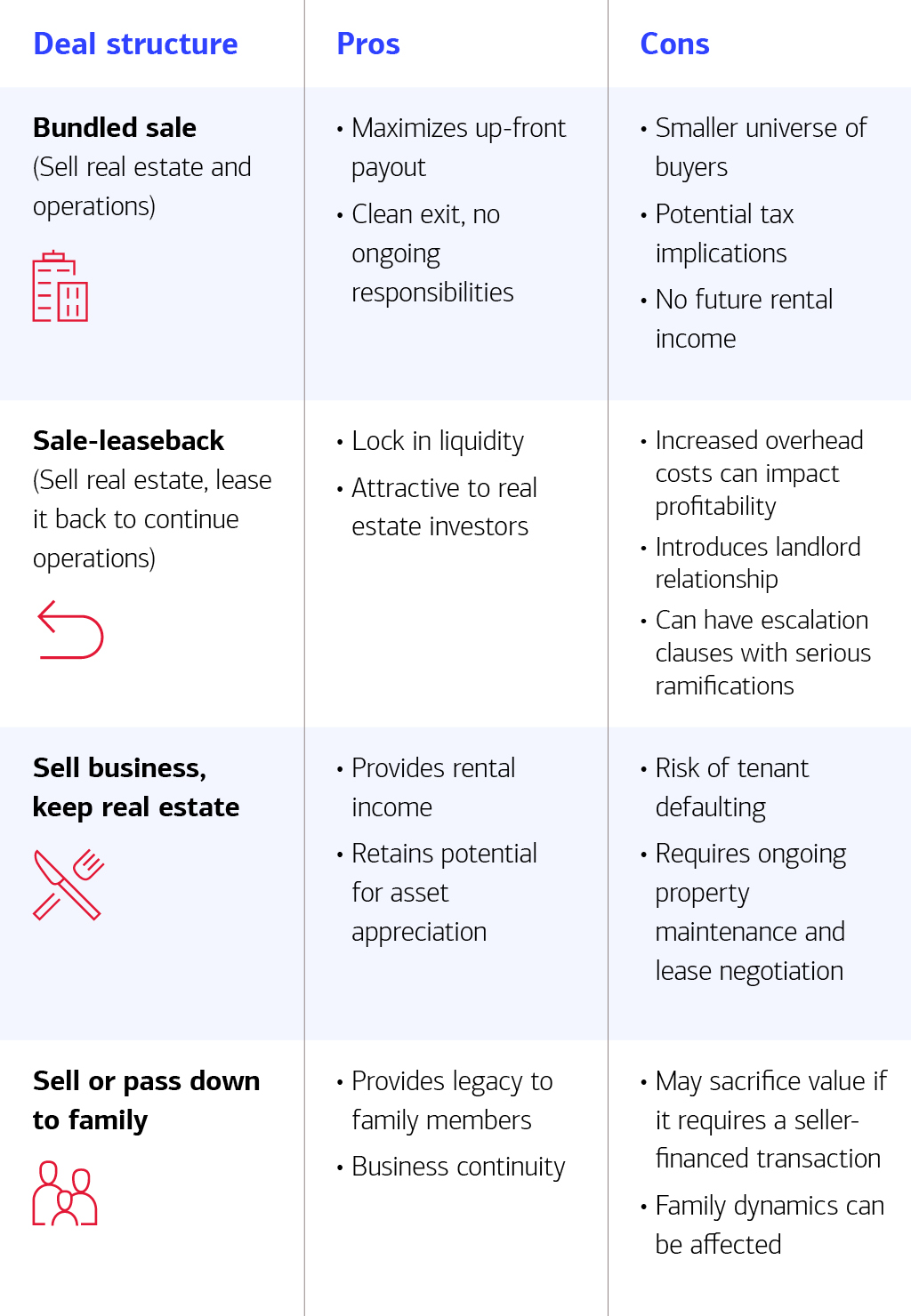

Pros and cons of several exit options

Find the right buyer

The optimal buyer would be somebody who already owns stores in your area and within the same brand. Strategically, someone may be willing to pay more in that situation because of the operating efficiencies. For example, a current regional manager may be able to just absorb the addition of your stores into their daily job. And both you and the franchisor will be familiar with those players.

Another key factor is the buyer’s ability to obtain the necessary financing and close the deal in a timely fashion. As a bank, we can sometimes help the process along by providing a letter for the buyer that says this is a good client of ours and we will work closely with them on financing should they win the bid.

Plan for family succession

Even when a family member is involved, you can’t hand over the business without the franchisor’s approval, and making changes to your ownership agreement can take up to a year to get approved. But realistically, most restaurant owners don’t go from “Mom and Dad are involved” to “Mom and Dad are not involved” in running the stores. It’s usually a gradual process that owners have been doing all along, so preparing is often a matter of making sure that the transition is part of your overall estate planning.

Strategies and considerations for family transfers

- When transferring restaurants to relatives, the franchisor must still approve.

- It’s more common to transfer a percentage over time in a gradual process. This gives the receiving family member time to become adept at managing the restaurants while the original owner is still in charge.

- The transfer could be part of an estate plan. The owner might transfer a percentage ownership to a separate entity such as an LLC, which may also be held in trust.

Be strategic with real estate

If a franchisee owns the land under their buildings, they have several options beyond just selling it with the franchise. An owner can cash out by selling the business and real estate together. But they also can sell only the business, keeping the real estate and collecting rent from the new owner. Or they can sell the real estate alone without the business, lease it back and continue to run the business.

The option you choose will depend on your preference for an immediate lump sum payout or ongoing passive income. “Do you want to get completely out now, or would you rather collect a stream of income while your real estate continues to appreciate? Those are questions that our wealth management team has lots of experience with and can help you weigh as you figure out the right path for your goals,” says Sanger.

Ready to meet with a specialist?

Our specialists are ready with advice and guidance to help move your business forward.

Why successful business succession starts long before you’re ready

Gracefully exiting your business requires aligning personal financial goals with business strategy — before it’s time to leave. Knowing the seven succession options can help you get started.

Important Disclosures and Information

Bank of America, Merrill, their affiliates and advisors do not provide legal, tax or accounting advice. Consult your own legal and/or tax advisors before making any financial decisions. Any informational materials provided are for your discussion or review purposes only. The content on the Center for Business Empowerment (including, without limitations, third party and any Bank of America content) is provided “as is” and carries no express or implied warranties, or promise or guaranty of success. Bank of America does not warrant or guarantee the accuracy, reliability, completeness, usefulness, non-infringement of intellectual property rights, or quality of any content, regardless of who originates that content, and disclaims the same to the extent allowable by law. All third party trademarks, service marks, trade names and logos referenced in this material are the property of their respective owners. Bank of America does not deliver and is not responsible for the products, services or performance of any third party.

Not all materials on the Center for Business Empowerment will be available in Spanish.

Certain links may direct you away from Bank of America to unaffiliated sites. Bank of America has not been involved in the preparation of the content supplied at unaffiliated sites and does not guarantee or assume any responsibility for their content. When you visit these sites, you are agreeing to all of their terms of use, including their privacy and security policies.

Credit cards, credit lines and loans are subject to credit approval and creditworthiness. Some restrictions may apply.

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (“BofA Corp.”). MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC, and a wholly owned subsidiary of BofA Corp.

Banking products are provided by Bank of America, N.A., and affiliated banks, Members FDIC, and wholly owned subsidiaries of BofA Corp.

“Bank of America” and “BofA Securities” are the marketing names used by the Global Banking and Global Markets division of Bank of America Corporation. Lending, derivatives, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Trading in securities and financial instruments, and strategic advisory, and other investment banking activities, are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, BofA Securities, Inc., which is a registered broker-dealer and Member of SIPC, and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. is a registered futures commission merchant with the CFTC and a member of the NFA.

Investment products: