1 IBM, “Cost of a Data Breach Report,” 2024.

Restaurant accounts payable fraud prevention: Reducing cybersecurity risks

October 30, 2025 | 4 minute read

Key takeaways:

- Fraud aimed at back-office operations is becoming a greater risk as transactions become more automated.

- Safeguards for accounts payable transactions can help protect the restaurant and increase employee awareness of the new threat landscape.

- As more advanced technology is helping control credit card fraud, hackers are turning to phishing emails to dupe employees.

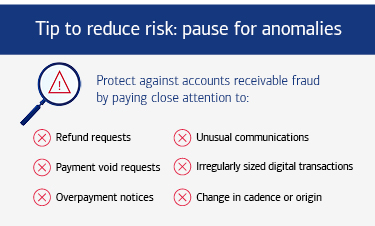

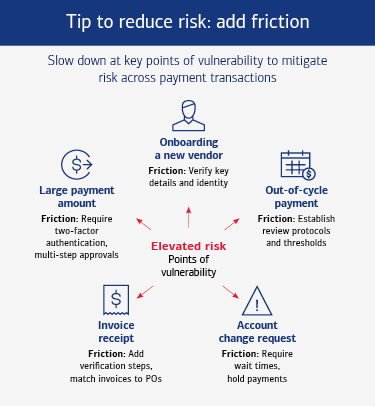

- Train employees to beware of anomalous requests; sometimes friction is necessary for transaction security.

The rapid adoption of digital technology for payments, operations and customer engagement has helped restaurants substantially grow their business in just a few years, but it also has provided criminals with troubling new opportunities to steal money and critical data.

Between March 2023 and February 2024, the average cost associated with a data breach in the hospitality industry — which includes hotels, cruise lines and restaurant chains — reached $3.82 million, up from $3.36 million during the same period in 2022–2023.1 Technology allows criminals to have more access points to operations, and restaurants that haven’t upgraded their processes are at increased risk. Plus, there’s the turnover issue, which creates additional vulnerabilities. Restaurants are constantly hiring new employees, who have less familiarity with internal controls and vendor and supplier relationships.

The average cost of a hospitality industry data breach reached $3.82 million between March 2023 and February 2024.

Becoming more aware of fraud

Consumer demand for active measures to protect their credit card information has led to better security along payment rails and the rollout of more advanced point of sale solutions that encrypt data. “Consumers are more fraud savvy,” says Shannon O’Donnell, senior merchant specialist with Bank of America. “They’re more aware of the safeguards in place, so they’re more open to making point of sale payments at the table.”

Nonetheless, the rapid increase in digital sales at quick service restaurants (QSR) through apps, third-party platforms and websites has also opened the door for more credit card fraud, fraudulent chargebacks and even compromised point of sale systems. Each digital payment channel represents another area where adaptable cyber defenses are necessary.

Restaurants should be aware that back-office operations and accounts payable (AP), in particular, are also more frequent targets for fraud. Complex supply chains and an increasing number of vendor and third-party suppliers have introduced many new potential access points for fraud and data breaches. Meanwhile, criminals continue to make use of well-known but still highly effective methods, such as phishing emails and malicious attachments, to trick overstretched employees.

Phishing vulnerabilities in accounts payable

Fraudsters have become more sophisticated over time and now deploy some of the same tools used by legitimate businesses — such as chatbots and large language models — to produce scam emails and requests that look legitimate. There has been a recent boom in fraud where back-office workers get emails from what appears to be a known vendor asking to change the payment details for invoices. The money then gets sent to a criminal instead of the actual vendor.

Unfortunately, the level of control AP departments have over payments has thinned as they increasingly turn to third-party middlemen to help execute transactions. Simply put, there are more points along a payment pathway, and each represents an opportunity for fraud.

That’s why restaurants of all formats need to remain especially vigilant to identify anomalous activity or requests from a vendor. Onboarding a new vendor always carries risk, especially for companies that do not have robust policies in place for verifying the vendor’s identity (e.g., background checks, verification of licenses or submission of W-9 forms or tax ID numbers).

Engaging banks for transaction security

Increasingly, businesses are setting up relationships with vendors that are exclusively digital, in which human-to-human interaction, which can provide a basic security safeguard, is largely absent. The risk of fraud also goes up when companies are paying for non-material charges, such as consulting services.

To manage this risk, Charles Murphy, senior treasury sales specialist at Bank of America, argues that restaurants need to lean on transaction experts. “They really should engage their bank. Restaurants are in the business of serving food. Financial institutions are in the business of securely moving money,” he says. “They have a lot of intelligence to share, as well as solutions that can help manage back-office workstreams, protect sensitive account information, verify the legitimacy of vendor requests and implement fraud controls.”

Friction is necessary to improve transaction security

Effective defense against AP fraud begins with recognizing that cyber fraudsters have observed the shift to ACH payments and ramped up activity in response. Employees receiving an invoice or request for payment from an established vendor — even one that matches their known contact information — can no longer assume the communication is legitimate.

When onboarding new vendors, employees should take the necessary time to record and verify key details, such as company or personal information and the routing numbers and contact information of the financial institution to which the vendor directs payments.

To increase transaction security, AP departments can also create friction, or slow the process, by establishing review protocols and thresholds for any requests to change accounts or process out-of-cycle payments. Rather than framing the process as a delay, AP staff can present it as a necessary step for ensuring the security of the vendor’s accounts as well as their own.

Combating cybercrime and fraud will require ongoing technological refinements. A good defense depends on educated, alert employees who adopt a rigorous approach to security and do not assume communications are legitimate simply because they appear to come from established vendors and partners. A well-trained employee is the best line of defense against a serious breach that could affect your organization’s bottom line and reputation. The key to that training? Make sure employees know how to leverage technology — without putting their unqualified trust in it.

Explore more

Ready to meet with a specialist?

Our specialists are ready with advice and guidance to help move your business forward.

Transaction security in a digital economy

How to protect your business from transactional cyber-fraud.

Important Disclosures and Information

Bank of America, Merrill, their affiliates and advisors do not provide legal, tax or accounting advice. Consult your own legal and/or tax advisors before making any financial decisions. Any informational materials provided are for your discussion or review purposes only. The content on the Center for Business Empowerment (including, without limitations, third party and any Bank of America content) is provided “as is” and carries no express or implied warranties, or promise or guaranty of success. Bank of America does not warrant or guarantee the accuracy, reliability, completeness, usefulness, non-infringement of intellectual property rights, or quality of any content, regardless of who originates that content, and disclaims the same to the extent allowable by law. All third party trademarks, service marks, trade names and logos referenced in this material are the property of their respective owners. Bank of America does not deliver and is not responsible for the products, services or performance of any third party.

Not all materials on the Center for Business Empowerment will be available in Spanish.

Certain links may direct you away from Bank of America to unaffiliated sites. Bank of America has not been involved in the preparation of the content supplied at unaffiliated sites and does not guarantee or assume any responsibility for their content. When you visit these sites, you are agreeing to all of their terms of use, including their privacy and security policies.

Credit cards, credit lines and loans are subject to credit approval and creditworthiness. Some restrictions may apply.

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (“BofA Corp.”). MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC, and a wholly owned subsidiary of BofA Corp.

Banking products are provided by Bank of America, N.A., and affiliated banks, Members FDIC, and wholly owned subsidiaries of BofA Corp.

“Bank of America” and “BofA Securities” are the marketing names used by the Global Banking and Global Markets division of Bank of America Corporation. Lending, derivatives, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Trading in securities and financial instruments, and strategic advisory, and other investment banking activities, are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, BofA Securities, Inc., which is a registered broker-dealer and Member of SIPC, and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. is a registered futures commission merchant with the CFTC and a member of the NFA.

Investment products: