Why should employers offer a workplace retirement plan?

June 9, 2025 | 3 minute read

There’s a reason so many businesses offer retirement plans as part of their employee benefit packages. They’re not only great for employees—they’re great for the companies that offer them, too. If you’re wondering whether you should establish a workplace retirement plan, you’ve come to the right place. Read on and find just what you need to know to feel confident about choosing the right plan for your business.

Winning the war for talent

Lorna Sabbia, Managing Director, head of Bank of America Workplace Benefits™, explains how benefit plans can be the lynchpin of your efforts to attract and retain top talent.

The bottom line and beyond: Business benefits

The numbers say it all. Employers who offer workplace retirement plans are helping fuel their businesses along with their employees’ financial wellness.

Attract and retain top talent — 72% of plan sponsors either agreed or strongly agreed that offering a robust retirement benefits plan is an effective employee recruitment and retention tool.1 And 39% of employees listed competitive workplace benefits as the top reason they stayed with their employer.2

Tax advantages — The tax benefits available to employers who offer a workplace retirement plan can actually offset the cost of the plan itself. That’s because employer contributions and plan expenses are generally deductible from the employer’s income. Tax credits for small businesses are also available.

Flexible plan design — Employers can choose to make matching contributions, profit sharing contributions, other special types of contributions or no contributions at all. Some plans also let you decide how soon your employees fully vest. This can be a valuable incentive for retention.

Improved employee morale — Retirement plans help employees feel more secure about their futures. This can improve morale, which, in turn, may boost productivity and reduce turnover.

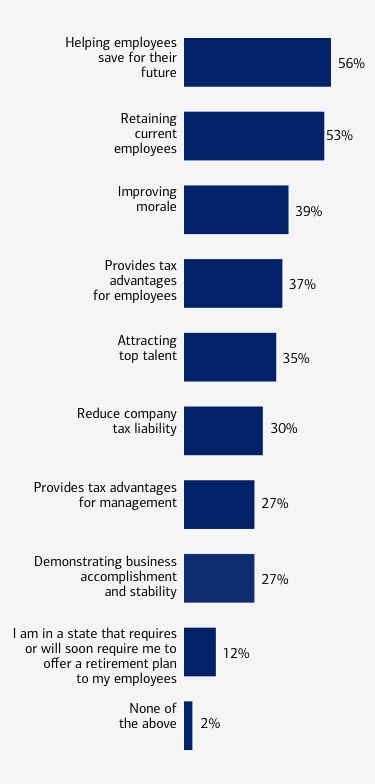

Why do small businesses provide 401(k) plans?

Reasons companies provide 401(k) plans

Among companies with 1 to 49 employees and assets of <$50MM

Source: 2025 Bank of America Workplace Benefits Report Survey

A changing regulatory landscape

Many states in the U.S. are moving toward requiring employers to offer retirement plans to their employees. Providing your employees with access to a retirement plan now can help ensure you stay ahead of legislative requirements, even if your state hasn’t yet enacted a mandate. To learn more, check out this fact sheet about state retirement plan mandates and how they might affect your business.

Bank of America Workplace Benefits™ for small business owners and entrepreneurs

Find out how our experienced team can help you build a benefits plan that truly fits your business's needs.

How do employers choose and set up a workplace retirement plan?

Picking the right plan for your business and getting it off the ground is easier than you might think.

Bank of America Workplace Benefits™ is here to help your business — and your employees — thrive

Find out how our experienced team can help you build a benefits plan that truly fits your business's needs.

Important Disclosures and Information

Bank of America, Merrill, their affiliates and advisors do not provide legal, tax or accounting advice. Consult your own legal and/or tax advisors before making any financial decisions. Any informational materials provided are for your discussion or review purposes only. The content on the Center for Business Empowerment (including, without limitations, third party and any Bank of America content) is provided “as is” and carries no express or implied warranties, or promise or guaranty of success. Bank of America does not warrant or guarantee the accuracy, reliability, completeness, usefulness, non-infringement of intellectual property rights, or quality of any content, regardless of who originates that content, and disclaims the same to the extent allowable by law. All third party trademarks, service marks, trade names and logos referenced in this material are the property of their respective owners. Bank of America does not deliver and is not responsible for the products, services or performance of any third party.

Not all materials on the Center for Business Empowerment will be available in Spanish.

Certain links may direct you away from Bank of America to unaffiliated sites. Bank of America has not been involved in the preparation of the content supplied at unaffiliated sites and does not guarantee or assume any responsibility for their content. When you visit these sites, you are agreeing to all of their terms of use, including their privacy and security policies.

Credit cards, credit lines and loans are subject to credit approval and creditworthiness. Some restrictions may apply.

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (“BofA Corp.”). MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC, and a wholly owned subsidiary of BofA Corp.

Banking products are provided by Bank of America, N.A., and affiliated banks, Members FDIC, and wholly owned subsidiaries of BofA Corp.

“Bank of America” and “BofA Securities” are the marketing names used by the Global Banking and Global Markets division of Bank of America Corporation. Lending, derivatives, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Trading in securities and financial instruments, and strategic advisory, and other investment banking activities, are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, BofA Securities, Inc., which is a registered broker-dealer and Member of SIPC, and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. is a registered futures commission merchant with the CFTC and a member of the NFA.

Investment products: